China's Belt and Road Loses a Notch and Gains a Bump: Ukraine and the BRI

- Elizabeth Wishnick

- May 10, 2022

- 6 min read

With the invasion of Ukraine by Russia in full sway, China’s plans to expand trade and fortify transportation ties with Central and Eastern Europe have been thrown into disarray. Yet, even though the invasion of Ukraine poses a direct threat to Xi Jinping’s signature Belt and Road Initiative and harms China’s own economic interests in Ukraine, Chinese leaders have maintained their implicit support for Russia, their strategic partner.

China’s Eurasian Plans Endangered

Just two months ago, the Belt and Road Initiative (BRI) appeared to have more promising prospects in the region. On February 3, 2022, one day before Russian President Vladimir Putin met with Xi Jinping, China’s leader spoke enthusiastically with Polish President Andrzej Duda about turning Poland into a logistics hub for a key artery of China’s BRI, the New Eurasian Land Bridge. For his part, Duda – the only leader from a European democracy to attend the Winter Olympics opening ceremony – took advantage of his meeting to convey Europe’s opposition to Russia’s military buildup on Ukraine’s borders.

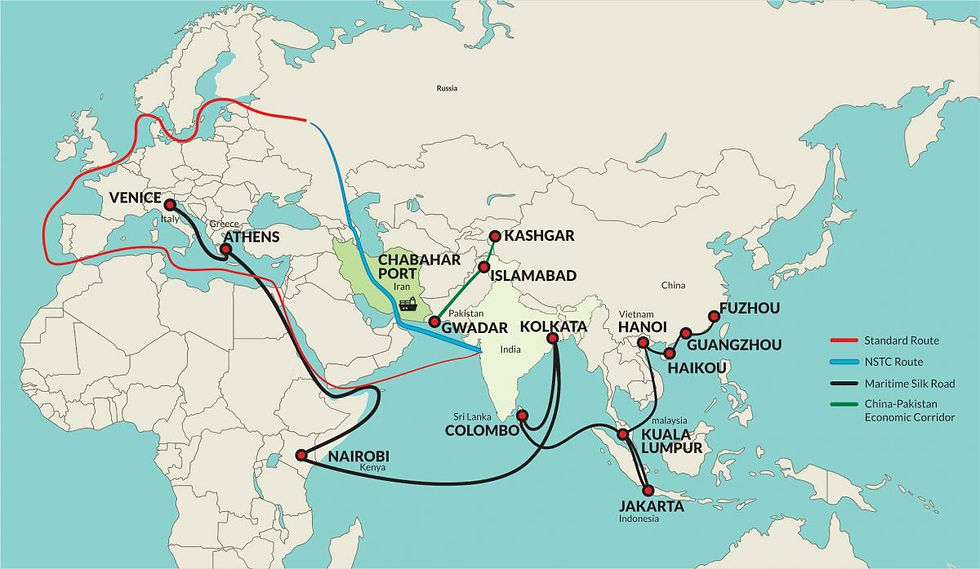

Now the picture looks noticeably less rosy. Although the key rail link from Chengdu in China to Łódź in Poland circumvents Ukraine, other important arteries such as the direct line from Changsha in China’s Hunan province to Chop in Western Ukraine and the Xian-Budapest line, which passes through Kyiv, are in doubt. Moreover, Poland, a NATO ally and EU member, is now playing a key role as a weapons conduit for Ukraine, with which it shares a 332 km border. China’s perceived implicit support for the Russian invasion will likely dampen enthusiasm for greater Polish cooperation with the BRI. Despite signing an agreement with Beijing on the initiative in 2015, skepticism about relations with China had been growing in Poland, which has taken in over three million Ukrainian refugees.

Chinese Interests at Risk

Meanwhile, China’s own investments in Ukraine are facing the consequences of a protracted violent conflict. Chinese companies had invested in dredging the port of Mariupol, a city which Russian forces have nearly completely destroyed. Chinese wind power companies also invested in Mariupol, as well as in the port of Yuzhny, near Odesa, now effectively blockaded by Russian naval forces. While an analysis by China’s Daily Economic News sought to downplay the impact of the war on most Chinese investments, Ukraine was described as one of the largest markets for Xinjiang Beiken Energy Engineering, a private Chinese energy technology company, which has a major partnership with Ukraine’s Naftogaz UkrGasVydobuvannya (UGV) in Poltava, also the target of major Russian attacks.

Although China’s trade and investment in Ukraine is relatively modest (as compared to Kazakhstan, for instance), Xi’s choice to stand by Putin has been costly for the Belt and Road Initiative. China-Europe trade by rail is expected to fall by at least 35 percent since, prior to the Russian invasion, 90 percent went via the northern route which goes through Russia and Belarus. This route, the New Eurasian Land Bridge, conveyed Russian oil, wheat, and minerals to Europe. Major freight forwarders, such as Maersk and DHL, now refuse to work in Russia and Russian Railways – which is under sanctions – was declared in default on April 11. While just 4.45 percent of China-Europe trade traveled by rail in 2021, this involved 1.46 million TEUs (twenty-foot container unit equivalents) and represented a 20 percent increase over 2020. Rail experts expect it will take several years to recoup the decline in rail freight resulting from the Russian invasion of Ukraine.

Exploring Alternatives

One option for China is to focus on the China-Central Asia-West Asia Economic Corridor route, which transits through Central Asian countries, the Caspian Sea region, Iran, and Turkey. A new multi-modal service just began on April 13, 2022, on this route, involving rail transit from Xian via Kazakhstan, delivery across the Caspian Sea to Baku, then rail transit to Poti in Georgia, followed by shipment across the Black Sea – a battlespace in Russia’s war on Ukraine – to the Port of Constanţa in Romania, concluding in rail delivery to Mannheim, Germany. This route has been relatively underdeveloped and terminals are not large enough to accommodate trade redirected from the New Eurasian Land Bridge. In the short term this will contribute to additional delays on rail lines that are already known for unreliable arrival times, though in the long term, it may spur the growth of transit trade via Central Asia and the Caspian Sea region.

As an alternative, China may seek to focus more on developing the Maritime Silk Road, especially cooperation with Iran and Pakistan. Each of these options has its own challenges, however. China’s regional rival India has long been investing in Iran, which also signed a 25-year cooperation agreement with China, with a special focus on its Chabahar Port. Interest by both India and China could help foster regional trade with Central and South Asia, or, conversely lead to competition between Beijing and New Delhi for influence in Iran, potentially benefiting the latter. The port city of Gwadar in Pakistan, a centerpiece of the China Pakistan Economic Corridor, is no model – in December 2021 it was the site of mass protests and thus far has not lived up to the hype around it as a key node in the Maritime Silk Road.

Now boasting the world’s largest navy, with a fleet of 355 vessels, China faces a strategic choice between positioning itself as a continental or a maritime power. Naval historian Bruce Elleman sees China’s support for Putin’s Ukraine invasion as tying Beijing to continental power, as opposed to becoming more integrated into a global maritime order. However, even if China opts for greater regional economic integration through maritime power, its domestic imperatives will set limits to its constructive participation.

At this writing, Xi’s authoritarian zero-COVID strategy is further snarling supply chains due to lockdowns in Shanghai and several other key port cities. Shanghai, a city of 25 million people, has been under an extensive and prolonged lockdown, despite a less than 1 percent COVID positivity rate. While shipping and freight workers have been in residence at the port, which accounts for 20 percent of China’s container trade, truck drivers face restrictions and manufacturers have experienced closures.

China’s Tough Sell in Europe

Apart from economic troubles, political tensions with Europe are also growing. Beijing journalist Xue Qing admits that the “China-Europe relationship is now being sorely tested by the Russia-Ukraine war.” Prior to the Russian invasion of Ukraine, China already faced several challenges to its European diplomacy on numerous fronts. Arctic states had grown wary of potential ulterior motives in Chinese investment and claims of being a “near-Arctic state.” By 2021, China’s framework for economic engagement with Europe – the 17+1 initiative (now 16 +1 after Lithuania’s departure) – was criticized for being a “zombie mechanism” due to its lack of results.

In this context, it is not surprising that Beijing, known for its enthusiastic rhetoric about the BRI, has been unusually reticent about its prospects in Europe of late. China’s grand connectivity schemes must address a growing number of unwelcome developments, such as deepening connections between European democracies and Taiwan, the unexpectedly strong outpouring of global support for Ukraine, unprecedented Euro-Atlantic unity over the response to the Russian invasion, and even greater Swedish and Finnish interest in joining NATO. In the short term, we may see a refocusing of effort, highlighting cooperation with the more pro-China countries like Serbia, which recently very publicly received an infusion of Chinese military aid.

The long-awaited April EU-China summit produced no breakthroughs – to the contrary Josep Borrell, the EU’s High Commissioner for Foreign and Security Affairs, quipped that “[i]t was not exactly a dialogue – maybe a dialogue of the deaf.” Indeed, the two countries had very different agendas going into the meeting. For the EU, the priority was ending the Russian invasion of Ukraine, which China is seen as supporting tacitly. Just before the EU summit, China’s Foreign Minister Wang Yi met with the Russian Foreign Minister, telling him that “China-Russia relations have withstood the new test of evolving international landscape, remained on the right course, and shown resilient development momentum.” Despite the interrupted trade due to the Russian invasion of Ukraine, Xi told European leaders that China’s vision of “a bridge of friendship and cooperation across the Eurasian continent” remains all the more relevant today and advocated greater communication and cooperation between his country and the EU.

The EU Enters the Rings with China: https://www.bmindstoday.com/heres-what-you-need-to-know-about-eu-s-latest-actions-against-china/

Nevertheless, this remains a tough sell, especially in Central Europe, where Huo Yuzhen, China’s special representative to China-Central and Eastern Europe Cooperation, is led a delegation to the Czech Republic, Slovakia, Hungary, Croatia, Slovenia, Estonia, Latvia, and Poland (but notably excluding Lithuania). Huo’s daunting tasks were to reinvigorate cooperation between China and Central Europe and explain China’s policy on Russia’s invasion of Ukraine, which many Central Europeans consider an endorsement and an indicator of the potential threat China itself may pose to the region. The Chinese envoy's efforts most likely failed to shift perceptions of China's loyalties and goals, exposing the broader challenges to Beijing's standing in the region and the success of its grand connectivity plans.

This article was originally published as https://chinaobservers.eu/chinas-belt-and-road-loses-a-notch-and-gains-a-bump/. A shorter version was also published here https://www.cna.org/our-media/indepth/2022/05/chinas-belt-and-road-loses-a-notch-and-gains-a-bump.

Comments